If you’re planning to buy, develop, or refinance property in Kansas—especially in low-lying or river-adjacent areas—a flood elevation certificate might be a necessary document. This report isn’t just paperwork; it’s essential for determining flood risk, obtaining accurate flood insurance rates, and complying with FEMA and local building regulations.

Understanding when and why to request one can help property owners avoid delays, reduce insurance costs, and make better long-term decisions.

What Is a Flood Elevation Certificate?

A flood elevation certificate (EC) is a formal document prepared by a licensed land surveyor that shows a building’s elevation in relation to the base flood elevation (BFE)—the level where water is expected to rise during a major flood.

It includes details such as:

- Building location and footprint

- Ground and lowest floor elevation

- Type of foundation

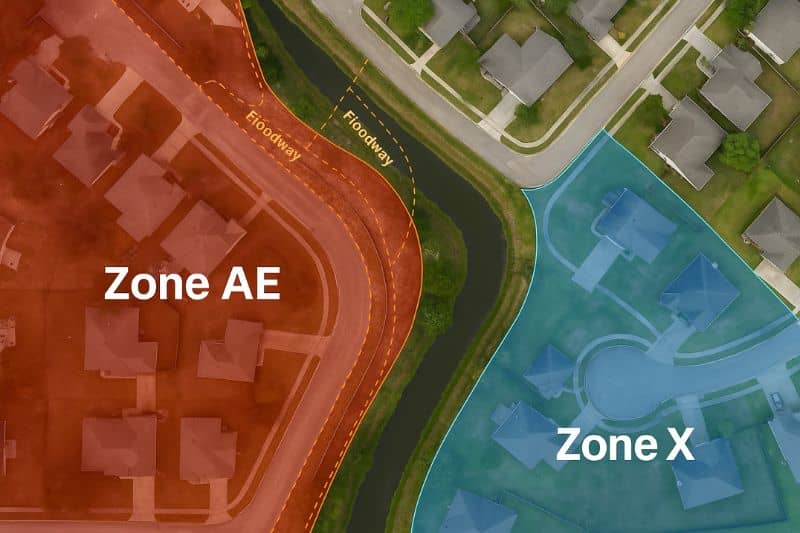

- Flood zone classification

- Surveyor’s certification of data

This information is critical for insurance under the National Flood Insurance Program (NFIP) and may be required when purchasing, refinancing, or building in flood-prone areas.

Why It Matters in Kansas

Kansas may not be a coastal state, but it does experience flooding—especially near rivers like the Kansas River, Missouri River, and Arkansas River. Cities like Wichita, Topeka, and Kansas City often have neighborhoods located within FEMA-designated Special Flood Hazard Areas (SFHAs).

Many counties require this certificate before issuing building permits in flood zones. Without it, you may face:

- Higher insurance premiums

- Delays in permitting

- Non-compliance with local ordinances

Who Needs a Flood Elevation Certificate?

You may need a flood elevation certificate if you are:

- Buying a home in a FEMA flood zone

- Applying for a federally-backed mortgage

- Building or expanding a structure in a high-risk flood area

- Trying to reduce flood insurance premiums

- Submitting a Letter of Map Amendment (LOMA) to revise a flood zone designation

When Is It Required in a Real Estate Deal?

You should request a flood elevation certificate before closing if:

- The property is within or near a 100-year floodplain

- You plan to develop or build on the lot

- Your lender or insurer asks for it

- You need to confirm the property’s true flood risk

Delaying it can result in setbacks for financing, permit approval, or insurance underwriting.

What’s Included in a Flood Elevation Certificate?

Here’s what your flood elevation certificate will typically show:

| Data Point | Details |

| Base Flood Elevation (BFE) | The flood height expected in a 100-year storm |

| Structure Elevation | Lowest adjacent grade, first floor elevation, etc. |

| Foundation Type | Slab, crawl space, basement, etc. |

| Location Info | GPS-based coordinates, legal address |

| Flood Zone | Determined using FEMA flood maps |

This data helps assess flood risk, verify code compliance, and ensure accurate insurance pricing.

How to Get a Flood Elevation Certificate in Kansas

To obtain one, follow these steps:

- Hire a licensed land surveyor in Kansas

- Provide the site address, legal documents, and any past surveys

- Expect the process to take 1–2 weeks

- Fees usually range from $500–$1,200, depending on complexity and location

Look for a professional land surveyor familiar with local floodplain regulations and FEMA standards.

How It Affects Flood Insurance Rates

Flood insurance companies use the elevation certificate to calculate your premium. If your lowest floor is above the base flood elevation, you may qualify for lower rates.

If you’re below the BFE, your rates could increase—or you may need to take floodproofing steps. Either way, having a valid certificate gives insurers clear data, helping you avoid unnecessary costs.

Common Mistakes to Avoid

Don’t get caught off guard by these common pitfalls:

- Assuming you don’t need a certificate if it’s not mentioned in the contract

- Relying on outdated FEMA flood maps

- Using a generic property survey instead of an official elevation certificate

- Forgetting to update your EC after remodeling or additions

Kansas-Specific Guidelines

Cities and counties in Kansas may enforce additional rules:

- Kansas City, MO/KS often requires a certificate before issuing permits near levees and drainage systems

- Topeka uses ECs to issue zoning and development approvals

- Check the FEMA Flood Map Service Center to see if your area lies within a Special Flood Hazard Area (SFHA)

Consult with local building departments or a licensed land surveyor for guidance.

Final Thoughts: Do You Need One?

If you’re buying or building in a Kansas flood zone—or even near one—don’t skip the elevation certificate. It can:

- Save you money on insurance

- Speed up the permitting process

- Confirm your property’s compliance with federal and local rules

Work with a licensed Kansas land surveyor to get accurate, up-to-date data and avoid surprises after closing.

FAQs

1. How long is a flood elevation certificate valid?

It doesn’t expire, but if the property changes or FEMA updates flood maps, a new one may be needed.

2. Can I get a lower flood insurance premium with a certificate?

Yes. A favorable elevation can reduce costs by hundreds per year.

3. Who usually pays for the certificate?

Usually the buyer, but in some transactions, it’s negotiated.

4. Do I need one for vacant land?

If you plan to build or need permits in a flood zone—yes.

5. Can I use one from the previous owner?

Only if there have been no changes to the building or flood maps—and the certificate is still accurate.